Algorithmic trading, commonly referred to as “Algo Trading” or “Automated Trading,” is a way to trade financial assets that automates transaction execution based on pre-established rules and methods.

In algorithmic trading, traders use algorithms that may automatically purchase or sell assets in the market using mathematical models and quantitative analysis tools to spot lucrative trading opportunities. These algorithms frequently draw inspiration from fundamental data like economic data and earnings reports as well as technical indicators like moving averages and price momentum e.g. – PE Ratio, RSI.

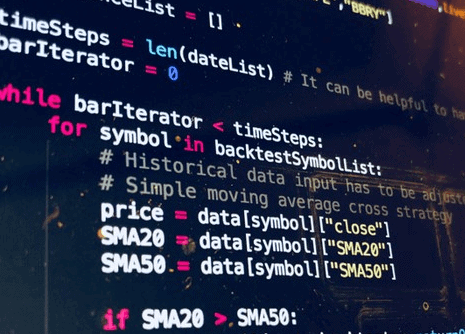

Once the algorithm is created, then coded into a computer system that can carry out trades according to pre-established rules and strategies. Trading can now be done more quickly and effectively than with the use of manual trading techniques..

A lot of market participants, including hedge funds, investment banks, and independent traders, use algorithmic trading. The availability of low-cost computer power and technological developments have led to an increase in its popularity in recent years. But, it also entails dangers, such as the potential for programming errors and technical hiccups that could result in substantial losses.

Always become familiar with fundamental tools / technical indicators before putting it through coding. One must have a plan before coding rather than code & backtest and then plan as per the backtested result.